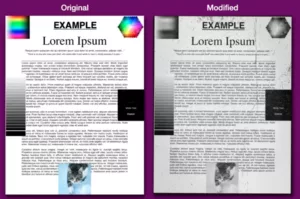

Filing your taxes is an annual responsibility that most people can’t avoid. But what happens when you’re ready to print your 1040 tax form, only to realize you’ve run out of black ink? Panic not! This blog post will walk you through how and why you can print your tax form using color ink, ensuring you meet your tax obligations without any hassle. The short story is to head over to the PDF Color Changing Tool and switch the color of the form right now.

Why Print in Color Ink? While it’s true that most tax forms are typically printed in black ink, there’s no rule that states you must use black ink exclusively. If you find yourself in a pinch and out of black ink, using color ink is a perfectly acceptable alternative. The key is to make sure your form remains legible and professional in appearance, which can be achieved by using a dark color.

How to Print Your 1040 Tax Form in Color Ink: Follow these simple steps to print your 1040 tax form using color ink:

- Download the Form: Visit the IRS website (www.irs.gov) and download the 1040 tax form that applies to your tax situation. Make sure to save the form on your computer in a location that’s easy to access.

- Visit the PDF Color Changing Tool and process your file.

- Change the Colors in the 1040 PDF: Select a dark color, such as dark blue. Make sure to avoid bright or light colors, as these can be difficult to read and may not be considered professional.

- Download the file!

- Print the Form: Once you have changed the colors to something likely to work on your printer, print your 1040 tax form using the selected color ink.

Conclusion: Running out of black ink shouldn’t stop you from filing your taxes on time. By following the steps above, you can easily print your 1040 tax form using color ink, ensuring that you meet your tax obligations without any delay. Just remember to choose a dark, legible color, and double-check your printed form for clarity before submitting it to the IRS.